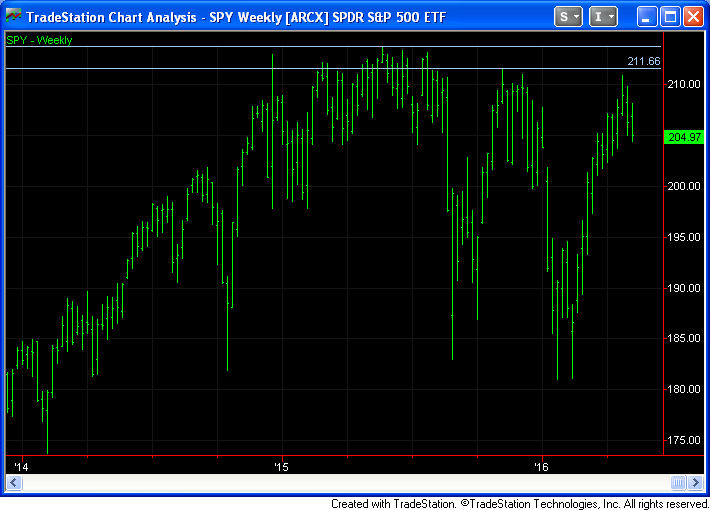

After 10 consecutive weeks of higher lows, the S&P final broke its previous week low. Bulls will say it’s taking a rest, but to me it looks like its fundamentally run out of juice. The blended earnings decline for Q1 is -7.6% according to FactSet, with the next three quarters estimated at -1%, +1.6% and +7.5%. A big bet currently on Q4 and we will most likely see that estimate decline as we approach the quarter.

Notice how price couldn’t reach the previous high. That looks like a test of the level which found sellers.

Now, I’ve been extremely busy this past month working on a number of projects. One of these was looking historical data to reach some conclusions on at asset allocation, historical multiples, inflation, rates, etc.

While a work in progress I’d like to share two conclusions.  Firstly regarding market valuation and forward returns. Looking at 144 years of data from Yale Professor Robert Shiller, the average forward

Firstly regarding market valuation and forward returns. Looking at 144 years of data from Yale Professor Robert Shiller, the average forward

1 year returns when the P/E is between 20 and 25 is -1%. That means that when the market is trading at 20-25x earnings we can expect on average to lose -1% over the next year. See the table on the right.

Now there is the argument that inflation is much lower and that it makes sense for the multiple range to shift to a higher level. So I took a look at the data from 1995 onwards. The conclusion appears to be similar. When the P/E has been below 20, investors achieved double digit returns but with 87 observations a P/E between 20 and 30 resulted in a gain of only 1%. See the table below.

The data uses GAAP EPS and so we must look at GAAP earnings to compare and this P/E is currently at 23x! Feel free to follow the multiple on Shiller’s site here and click on S&P 500 PE Ratio on the top left corner.

Another conclusion I reached was regarding asset allocation. Ray Dalio, Harry Browne and other similar “All Weather” type strategies have received a lot of publicity. They have produced excellent returns with low risk. This has attracted a lot of capital to Dalio and similar asset managers. So should we all employ such a strategy? These asset managers achieved these low risk returns because of a high concentration in bonds. Firstly, based on my calculations, I simple 60/40 allocation between equities and bonds would achieve a similar result as Dalio and company but without having to pay the hedge fund fees… But more importantly we need to ask what has happened since 1980? The answer is the biggest bull market in bonds ever! See the chart on the next page. As a result a 60/40 portfolio performed just as well as equities for the past 30 years with lower risk. But what happens if we look at a longer time frame? Equities clearly outperform. Over the 144 year period, I calculated an approximated 3% difference between equities and 60/40. Hence I expect that mean reversion will occur and equities will again produce superior returns to 60/40 and to similar strategies. Past performance is again no guarantee of future success.

During April, FatAlpha Active lost -1.9% due to a double whammy from Apple (AAPL). Not only did AAPL lose -14% during the month but Jabil Circuit (a portfolio holding and Apple supplier) followed suit at -10%. On the short side, value destroyer Pioneer Natural Resources (PXD) gained 18% and while I agree with Einhorn’s May 3rd assessment who is in the same boat as I, it isn’t any more comforting. The Market Neutral Strategy lost 1.1% as energy hurt returns there as well as it holds PXD and Cheniene Energy (an Icahn long and Chanos short). Acadia Healthcare is another short that rose in value as the market continues to like its debt binge acquisitions despite negative free cash flow and rich valuation. Positions that did well include Outerwall (OUTR) whose earnings surprised and Accelerated Diagnostics (AXDX) whose potential product viability is questionable and has been scrutinized in the past by the SEC.

I have exited the long position in Sanderson which was purchased in the 60s. The stock at 90 is at a premium to historical multiples and unless the export market opens up soon, I believe the stock we retrace as profits have been in decline due to the chicken prices. I also took profit in ACCO which is also trading near its high multiple. The office products business is in decline and if the Staples/Office Depot merger occurs then sales to the combined entity will take a hit.

Please note that over the next few weeks we will be relaunching the website. If you experience any problems accessing then please be patient as it is a domain issue (some time is needed for addresses to realign). For the past four years I have been using Wix which is also another publicly traded loss-making technology company. I will be moving the website to a WordPress design. This process has become an investment analysis on its own and this experience has led me to doubt Wix’s long-term viability and goals. But that is a discussion for another time… stay tuned…

Subscribe in order to receive the newsletter at the beginning of the month. Here it is posted with minimum one month delay. Click here to read the entire letter